The Psychology of Money

- Published on

- • 4 mins read•––– views

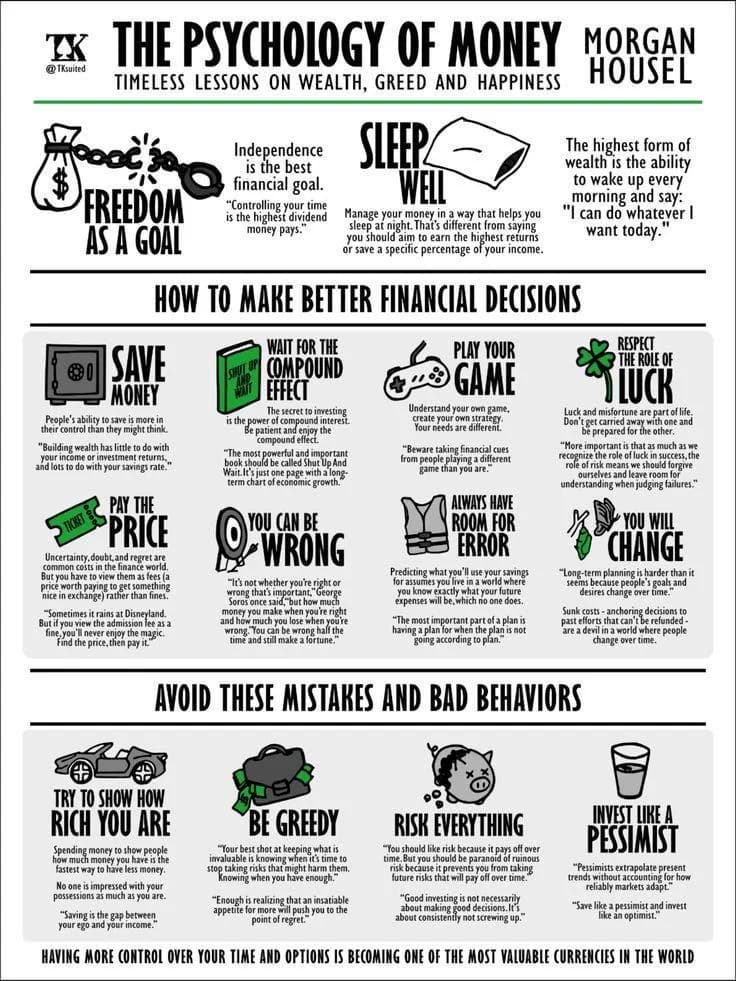

In The Psychology of Money, Morgan Housel uncovers the psychological forces that influence our financial decisions. He presents a collection of stories and insights about how people approach money, highlighting the emotional and behavioral aspects of finance rather than just the technical details.

Key Principles from The Psychology of Money:

1. The Power of Compounding

Housel explains that the most significant source of wealth is not just earning more, but allowing money to grow through compounding over time. Patience and time are key to financial success.

2. Risk and Luck

The book underscores the role of luck and risk in financial outcomes. Wealth is not always a result of skill, and recognizing that luck plays a part can help temper our expectations and decisions.

3. Wealth is What You Don’t See

Housel argues that true wealth is often invisible. People who appear wealthy may be living beyond their means, while those who are quietly accumulating wealth may not showcase their success.

4. The Dangers of Overconfidence

Many people overestimate their ability to predict financial markets or their own financial future. Housel warns against the dangers of overconfidence and encourages readers to embrace uncertainty and humility.

5. Saving vs. Earning

While earning more money is important, the ability to save effectively can often have a greater impact on long-term wealth. Housel stresses the importance of controlling spending and saving consistently, regardless of income level.

Key Takeaways:

- Time is Your Friend: The power of compounding is one of the most powerful tools in personal finance. Let your investments grow over time and be patient.

- Luck and Risk: Financial success isn’t always a result of hard work or skill; luck and risk play important roles. Recognizing this can lead to more balanced decision-making.

- True Wealth is Invisible: Real wealth is often understated and unrecognized, as it’s not always displayed through material possessions or status symbols.

- Avoid Overconfidence: Financial planning is full of uncertainty. Embrace humility and avoid the temptation to believe you can predict the future with certainty.

- The Importance of Saving: Saving money regularly, regardless of income, is often more important than earning a high salary when it comes to building wealth.

Actions I've Taken:

- Long-Term Investment Focus: I’ve shifted my focus towards long-term investments, letting compounding work in my favor over time, rather than seeking quick returns.

- Mindful of Risk and Luck: I approach financial decisions with a recognition of the role that both luck and risk play, keeping my expectations grounded and decisions balanced.

- Focus on Saving: I've made saving a consistent habit, ensuring that I am able to weather financial uncertainties, rather than solely focusing on increasing my income.

Why This Book Matters:

The Psychology of Money provides invaluable insights into the emotional and psychological aspects of money that often go overlooked in traditional financial advice. It teaches readers to build a mindset that is both humble and patient when it comes to wealth-building, ultimately guiding us toward a healthier relationship with money.

Personal Reflection:

The book has helped me reflect on my approach to money, emphasizing the need for patience and a long-term perspective. I’ve realized that building wealth is less about making huge strides quickly and more about consistently making good decisions over time. I also remind myself that financial security doesn’t necessarily mean flashy displays of wealth, and that financial peace comes from control over my spending and saving habits.